When faced with mounting debt, it’s essential to explore various options to find the best solution for your financial situation. One company that offers assistance in this area is Money Ladder, which connects individuals with debt settlement programs through its network of partners. In this comprehensive review, we’ll provide an unbiased look into Money Ladder’s services, evaluating their debt settlement programs and partners, to help you make an informed decision about whether they are the right choice for your needs.

Overview of Money Ladder

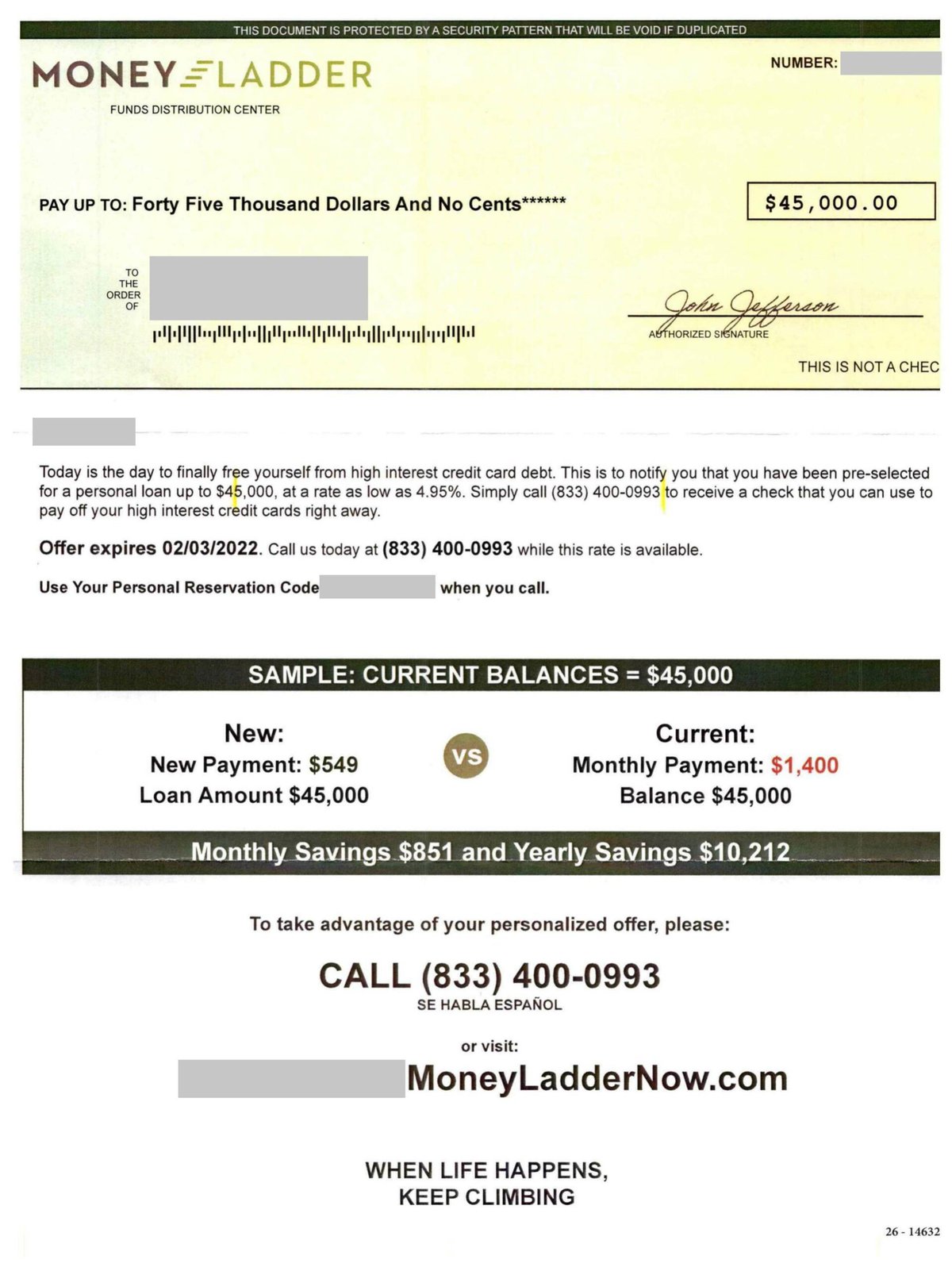

Money Ladder is a financial services company that specializes in connecting individuals with debt settlement programs offered by its partner companies. Their primary goal is to help consumers reduce their overall debt burden by negotiating with creditors to lower the amount owed. Through their network of partners, Money Ladder aims to provide personalized debt relief solutions tailored to each client’s unique financial situation.

How Does This Company Work?

Money Ladder operates by connecting you with debt relief firms that aim to decrease your debt through negotiations with creditors, primarily for unsecured debts like credit card balances. However, not every debt is eligible for the program and some clients may be unable to complete it due to various reasons, including insufficient savings.

The company cannot assure a specific reduction in debt amount or percentage, nor can it guarantee a precise time frame for becoming debt-free.

When enrolling in their debt resolution program, there’s no requirement to pay any upfront fees. Payment is only due once they have successfully negotiated a reduced overall debt with your creditors. Clients who remain in the program and settle all their debts generally save 20% after fees or 46% before fees.

Debt Settlement Programs Offered by Money Ladder’s Partners

Debt settlement programs offered by Money Ladder’s partners typically involve negotiating with creditors to reduce the total amount of debt owed. This can be a helpful option for individuals who are struggling to make minimum payments on their debts and need a more manageable repayment plan. Some of the potential benefits of these programs include:

- Reduced overall debt

- Single monthly program payment

- Potential to avoid bankruptcy

- Professional negotiation with creditors

However, it’s essential to understand that debt settlement programs can have drawbacks as well, such as:

- Negative impact on credit score

- Possible tax implications for forgiven debt

- Fees charged by the debt settlement company

BBB Rating & Reviews

Money Ladder has an A+ rating and accreditation from the BBB. Their BBB account has no reviews or complaints. Nonetheless, we discovered a few Trustpilot reviews. In general, customers have had varied experiences with Money Ladder.

Below are some of their Trustpilot reviews:

How do you repay Money Ladder?

Their website states, “You won’t have to pay for debt management services until you see the desired results from your program.”

If you manage to stay in the program and resolve all your debts, you can anticipate paying an average of 26% in fees.

Bear in mind that Money Ladder can only settle unsecured debts, such as credit cards or personal loans. They cannot assist with mortgages or auto loans.

It’s crucial to understand that debt negotiation is a means to help you eliminate debt, not a miraculous solution. You must still exercise financial discipline and avoid accumulating new debt. However, if you’re having difficulty handling multiple high-interest credit card debts, settling your debt may save you money and expedite your journey to becoming debt-free.

Comparing Money Ladder to Other Debt Relief Options

Before making a decision, it’s important to compare Money Ladder’s debt settlement programs with other debt relief options available in the market. Consider factors such as the range of services offered, fees, accreditation, and customer reviews to determine which option best fits your specific needs.

Some alternative debt relief options include:

- Debt consolidation loans

- Credit counseling and debt management plans

- Bankruptcy

Each of these options has its own set of pros and cons, so it’s essential to weigh them carefully against the debt settlement programs offered by Money Ladder’s partners.

The Impact on Your Credit Score

It’s important to understand how participating in a debt settlement program through Money Ladder’s partners will impact your credit score. Debt settlement can have a negative effect on your credit score, as settled debts are reported as “settled” rather than “paid in full” on your credit report. Be sure to weigh the potential credit score impact against the benefits of reducing your overall debt.

Conclusion: Is Money Ladder the Right Choice for You?

Ultimately, deciding whether Money Ladder is the right choice for you depends on your individual financial situation and preferences. By carefully considering their debt settlement programs, partner companies, and comparing them to other debt relief options, you can make an informed decision about whether Money Ladder can provide the support and guidance you need to achieve financial freedom. Remember that seeking professional guidance from a credit counselor or financial advisor is always advisable when making decisions about your financial future.

FAQs

What is Money Ladder?

Money Ladder is a company that connects clients with debt relief firms to help them reduce their unsecured debts, such as credit card balances, through negotiations with creditors.

Are there any reviews or complaints about Money Ladder on their BBB account?

No, there are no reviews or complaints on Money Ladder’s BBB account. However, you can find some reviews on Trustpilot.

What types of debt does Money Ladder help with?

Money Ladder primarily focuses on unsecured debts, such as credit card debts. Not all debts are eligible for their program, though.

Can Money Ladder guarantee a specific reduction in my debt amount or time frame for becoming debt-free?

No, Money Ladder cannot assure a specific reduction in debt amount or percentage, nor can it guarantee a precise time frame for becoming debt-free.

Glossary

- Money Ladder: A concept that refers to the idea of climbing the financial ladder through a series of steps or stages.

- Income: The money earned by an individual or organization through various sources, such as salary, investments, or business profits.

- Expenses: The money spent by an individual or organization to maintain their lifestyle, pay bills, or invest in assets.

- Saving: The act of setting aside money for future use or investment.

- Budgeting: The process of creating a plan for how to allocate one’s income, taking into account their expenses and financial goals.

- Debt: Money owed to creditors, such as credit card companies, banks, or other lenders.

- Credit score: A numerical representation of a person’s creditworthiness, based on their credit history and financial behavior.

- Investing: The act of putting money into assets with the expectation of generating a return on investment.

- Compound interest: Interest earned on the principal amount of an investment, as well as on any interest accrued over time.

- Retirement: The period of time when an individual stops working and relies on savings, investments, and pensions to support themselves.

- Emergency fund: Money set aside to cover unexpected expenses, such as medical bills, car repairs, or job loss.

- Frugality: The practice of living within one’s means and being mindful of expenses.

- Entrepreneurship: The act of starting and running a business, often with the goal of generating income and building wealth.

- Passive income: Income earned from investments, such as rental properties, stocks, or dividends, that require little to no effort to maintain.

- Financial independence: The state of having sufficient assets and income to support oneself without relying on a job or other external source of income.

- Net worth: The total value of an individual’s assets, such as property, investments, and savings, minus their liabilities, such as debt and other financial obligations.

- Inflation: The rate at which the general level of prices for goods and services is rising, reducing the purchasing power of money over time.

- Risk tolerance: The level of risk that an individual is willing and able to take on when investing or making financial decisions.

- Diversification: The practice of spreading one’s investments across multiple asset classes, such as stocks, bonds, and real estate, to reduce risk.

- Financial planning: The process of setting financial goals, creating a plan to achieve those goals, and regularly reviewing and adjusting the plan as needed.

- Debt consolidation companies: These are organizations that help individuals combine multiple debts into a single loan with a lower interest rate and manageable payment plan.

- Credit card debt: It refers to the amount of money owed by an individual to a credit card company due to purchases made using the credit card.

- American Fair Credit Council: Is an organization that provides education, support, and advocacy for consumers seeking debt relief services.

- Debt free: The state of being free from any financial obligations or liabilities owed to creditors or lenders.